Real Estate Capital Investments: A Path to Passive Revenue

Investing in property for capital is just one of the most effective methods to generate easy earnings and construct long-lasting wide range. Whether you're a experienced investor or simply starting, understanding the principles of capital financial investments can aid you make the most of returns and develop monetary security.

What is Real Estate Capital Investing?

Property cash flow financial investments focus on obtaining residential properties that generate regular rental income. The objective is to ensure that rental profits surpasses expenditures, including home loan payments, property taxes, upkeep, and management charges, resulting in a stable stream of easy income.

Why Purchase Capital Real Estate?

Passive Revenue Generation-- Regular rental earnings supplies financial safety and security and security.

Wide Range Building Gradually-- Admiration and equity growth enhance your total assets.

Tax Benefits-- Capitalists can make the most of reductions such as home mortgage interest, depreciation, and residential property expenditures.

Inflation Protection-- Rental earnings has a tendency to climb with rising cost of living, preserving purchasing power.

Diverse Investment Opportunities-- Financiers can choose from property, industrial, and multi-family residential or commercial properties.

Finest Realty Markets for Capital Investments

New York City City & Surrounding Locations-- High rental need and varied residential or commercial property choices.

Saratoga Springs, NY-- A expanding market with solid tourism and rental capacity.

Midwestern & Southern States-- Budget friendly properties with attractive rent-to-price proportions.

Suburban & University Towns-- Regular need from pupils and experts.

Secret Aspects to Consider When Investing

1. Favorable Cash Flow Calculation

https://greenspringscapitalgroup.com/available-properties/ Guarantee rental income exceeds expenditures.

Make use of the 1% Policy: Regular monthly lease ought to be at the very least 1% of the building's acquisition cost.

Calculate Net Operating Revenue ( BRAIN) and Cash-on-Cash Return to evaluate productivity.

2. Building Kind Selection

Single-Family Homes-- Less complicated to handle, consistent gratitude.

Multi-Family Properties-- Higher capital possibility, several income streams.

Short-Term Rentals-- High-income prospective but based on market fluctuations.

Industrial Real Estate-- Lasting leases with service lessees.

3. Financing & Take advantage of

Explore home loan choices and low-interest funding.

Use leverage sensibly to increase acquiring power.

Consider imaginative financing approaches like seller funding or partnerships.

4. Building Administration Technique

Employ a specialist home supervisor for problem-free investing.

Apply tenant testing procedures to decrease risks.

Keep properties to enhance occupant satisfaction and retention.

Difficulties & Threats of Cash Flow Investing

Openings Fees-- Empty systems lower income capacity.

Market Variations-- Financial downturns can impact rental need.

Unanticipated Expenses-- Maintenance, repair services, and real estate tax can influence cash flow.

Occupant Issues-- Late payments or residential property damages can lead to financial losses.

Techniques for Optimizing Property Capital

Buy High-Demand Areas-- Choose locations with strong rental demand and task growth.

Discuss Positive Financing Terms-- Lower interest rates https://greenspringscapitalgroup.com/available-properties/ improve cash flow.

Reduce Operating Costs-- Implement energy-efficient solutions and affordable maintenance.

Increase Rental Income-- Upgrade residential or commercial properties, offer furnished rentals, and supply amenities.

Utilize Tax Obligation Advantages-- Utilize deductions and tax obligation strategies to make the most of returns.

Real estate cash flow investments offer an superb possibility to produce passive income and build lasting riches. By selecting the right property, handling costs efficiently, and investing in high-demand locations, financiers can create a lasting revenue stream and accomplish financial liberty. Whether you're trying to find single-family rentals, multi-unit properties, or commercial financial investments, calculated cash flow investing can establish you on the path to success.

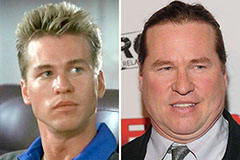

Val Kilmer Then & Now!

Val Kilmer Then & Now! Keshia Knight Pulliam Then & Now!

Keshia Knight Pulliam Then & Now! Lisa Whelchel Then & Now!

Lisa Whelchel Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!